In general, money orders can be considered a safe way to send or receive money, especially compared to cash or personal checks. Here’s why:

Pros:

- Prepaid: The money is guaranteed, unlike a check which relies on the sender’s bank account having sufficient funds.

- Traceable: You can track the status of a money order online or by phone, providing proof of payment.

- Replaceable: If lost or stolen, most money orders can be replaced with proof of purchase (usually the receipt).

- Widely accepted: Money orders are accepted by many businesses and individuals, making them a convenient payment option.

However, there are also some potential risks:

- Scams: Money orders are a common tool used in scams, so it’s important to be cautious when accepting them, especially for unexpected or online transactions.

- Fees: Purchasing money orders can involve fees, depending on the issuer and purchase method.

- Lost or damaged: Although replaceable, lost or damaged money orders can be inconvenient and require time to resolve.

To maximize the safety of using money orders, follow these tips:

- Purchase from a reputable issuer: Stick to well-known banks or postal services.

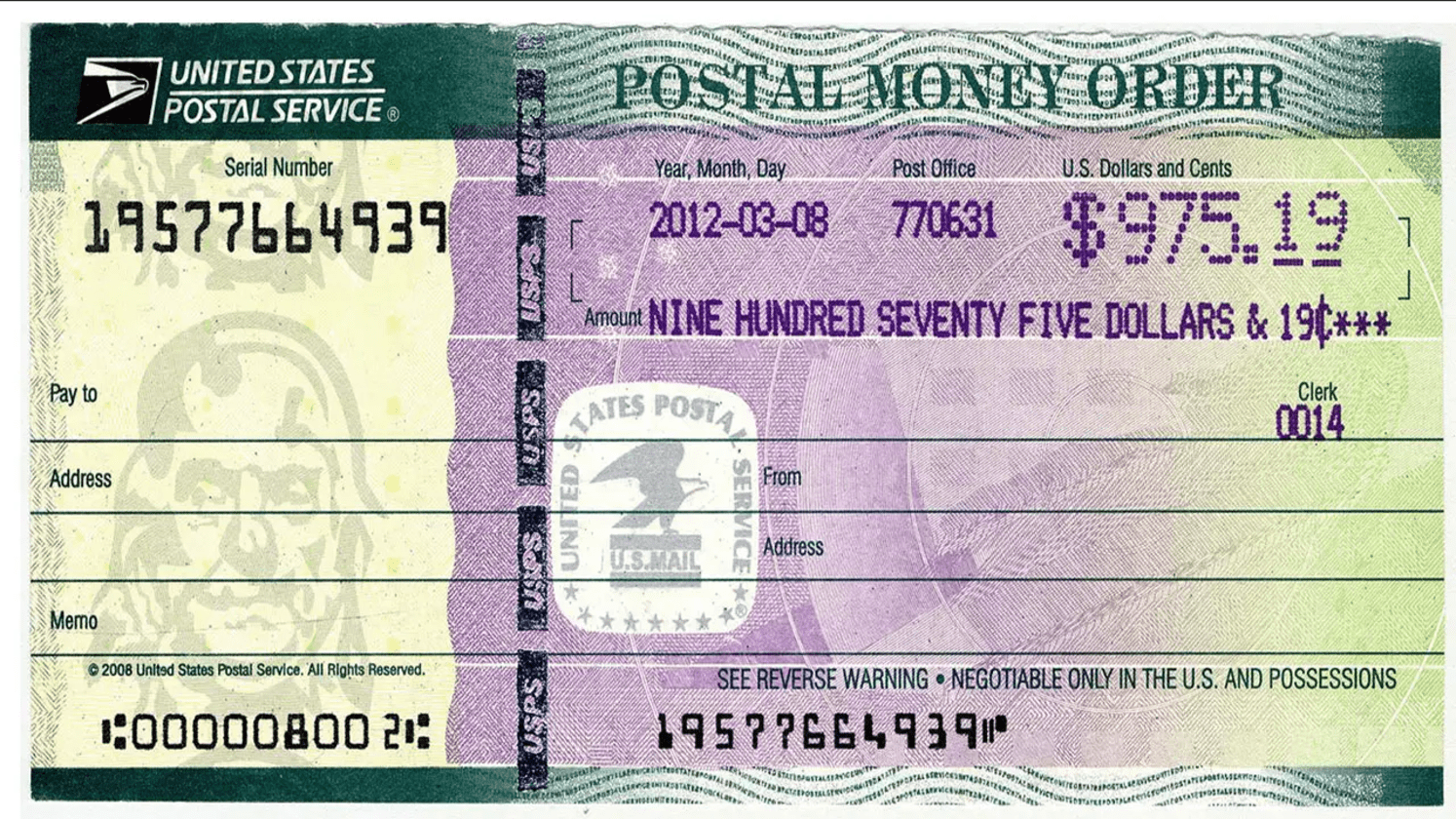

- Verify authenticity: Check for security features like watermarks and holograms.

- Keep the receipt: This is crucial for tracking and replacing the money order if needed.

- Be cautious of unexpected payments: If you receive a money order for an unsolicited transaction or from someone you don’t know, be wary of a scam.

Overall, money orders can be a safe and convenient way to send or receive money, but it’s important to be aware of the potential risks and take precautions to protect yourself. If you have any concerns about a specific transaction, it’s always best to err on the side of caution and consult with a trusted financial advisor.